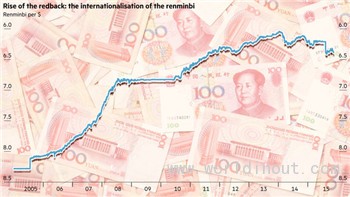

Nowhere in the global economy today is China more of a force than in the world of trade. That fact alone seems destined to propel the march of the renminbi, once considered an exotic currency, further into the mainstream.

China is now the largest exporter by some margin. Economists at the World Trade Organisation predict that its exports will account for more than 14 per cent of the value of goods exported around the globe by year-end, up from a little over 6 per cent a decade ago.

China is also on course to topple the US from its perch as the biggest importer, and accounted for just over 10 per cent of the value of imports around the world this year.

China’s emergence in the past decade as the leading trading nation has expanded the role of the renminbi to such an extent that in 2013, the currency overtook the euro as the world’s second choice in trade finance after the dollar, according to Swift, the global payments house.

In Asia, the renminbi is now the leading option for commerce between China and regional partners such as South Korea. Trade payments in renminbi to China and Hong Kong now account for almost a third of transactions, says Swift, compared with just 7 per cent three years ago.

The renminbi could cross a more significant symbolic threshold as the International Monetary Funds is set to go ahead with a widely anticipated decision to add the Chinese unit to its elite basket of global reserve currencies used to value its Special Drawing Rights (SDRs), currently the preserve of the British pound, the US dollar, the euro and the yen.

Stuart Tait, global head trade for HSBC, argues that using the renminbi in trade transactions no longer seems like an exotic idea. During a recent visit to China’s Pearl River Delta, a region where many export-focused companies are based, he was struck by how much the conversation had changed. “We talked about Rmb exposure in the way you would about any currency. It wasn’t this unique frontier issue,” Mr Tait says.

His belief that the renminbi’s role in global trade is likely to continue to grow was bolstered by an HSBC survey of 1,600 executives in 14 different markets in January and February that showed more than half expect to begin using the currency more in transactions.

However, while there is no doubt the renminbi is growing in stature, its ascent has not gone entirely unchallenged.

The euro’s role in trade has staged something of a comeback as its value has fallen and German exports have risen.

The HSBC survey also showed that not everyone is equally confident in the renminbi. Executives in Taiwan and Germany were more hesitant about the currency than more bullish peers in the UK, for example. Mr Tait believes that companies would be more comfortable if deeper renminbi markets developed around the world, offering greater liquidity.

There are also questions over whether some of the numbers used to support the more confident narratives over the renminbi truly reflect reality.

Swift says the renminbi is the currency behind almost 10 per cent of the trade carried out with letters of credit. But much of that trade is between mainland China and Hong Kong, or the mainland and Taiwan, and there have long been suspicions of significant “mis-invoicing” to evade capital controls.

When the IMF examined the role of the renminbi earlier this year as part of its review of whether to grant the currency SDR membership, it treated letters of credit between China and both Hong Kong and Taiwan as domestic trade. By that measure, the renminbi was behind just 3.8 per cent of the global value of letters of credit, which are dominated by the dollar.

Volatility in China’s markets over the summer and swings in the renminbi linked to the August announcement by the People’s Bank of China that it was changing the way the currency’s daily trading band is set have also caused concerns among investors.

China may be slowing. But, as Mr Tait points out, it is still growing faster than any advanced economy.

“It’s about keeping it all in context,” he says. “The Chinese growth in trade will continue to outpace global growth.”

And for a currency that has been building its place in the global economy on the back of trade, that is likely to mean a growing role for many years to come.